Bright Lands Education's mission is to provide the highest quality education and care for children in the US and Canada, focusing on nurturing their physical, cognitive, social, emotional, and linguistic development. We strive to create a safe and supportive environment for every child and maintain and strengthen the legacy of our business. Acquisition of centers from retiring owners is a key strategy for the industry. We believe in continuously improving and enhancing our services to meet the evolving needs of families in our community and providing the best possible experiences for every child in our care.

Bright Lands Education will focus on acquiring for-profit centers with an average revenue of $1 million and an EBITDA margin between 15% and 25%, with positive net cash flow. Depending on the age mix, these centers may accommodate 40 or more children.

The acquisition process is planned to begin during the first quarter of 2024. The company anticipates a smooth transition from the previous owner, which can take approximately 6 to 18 months. Bright Lands Education plans to operate using a hub-and-spoke operational style.

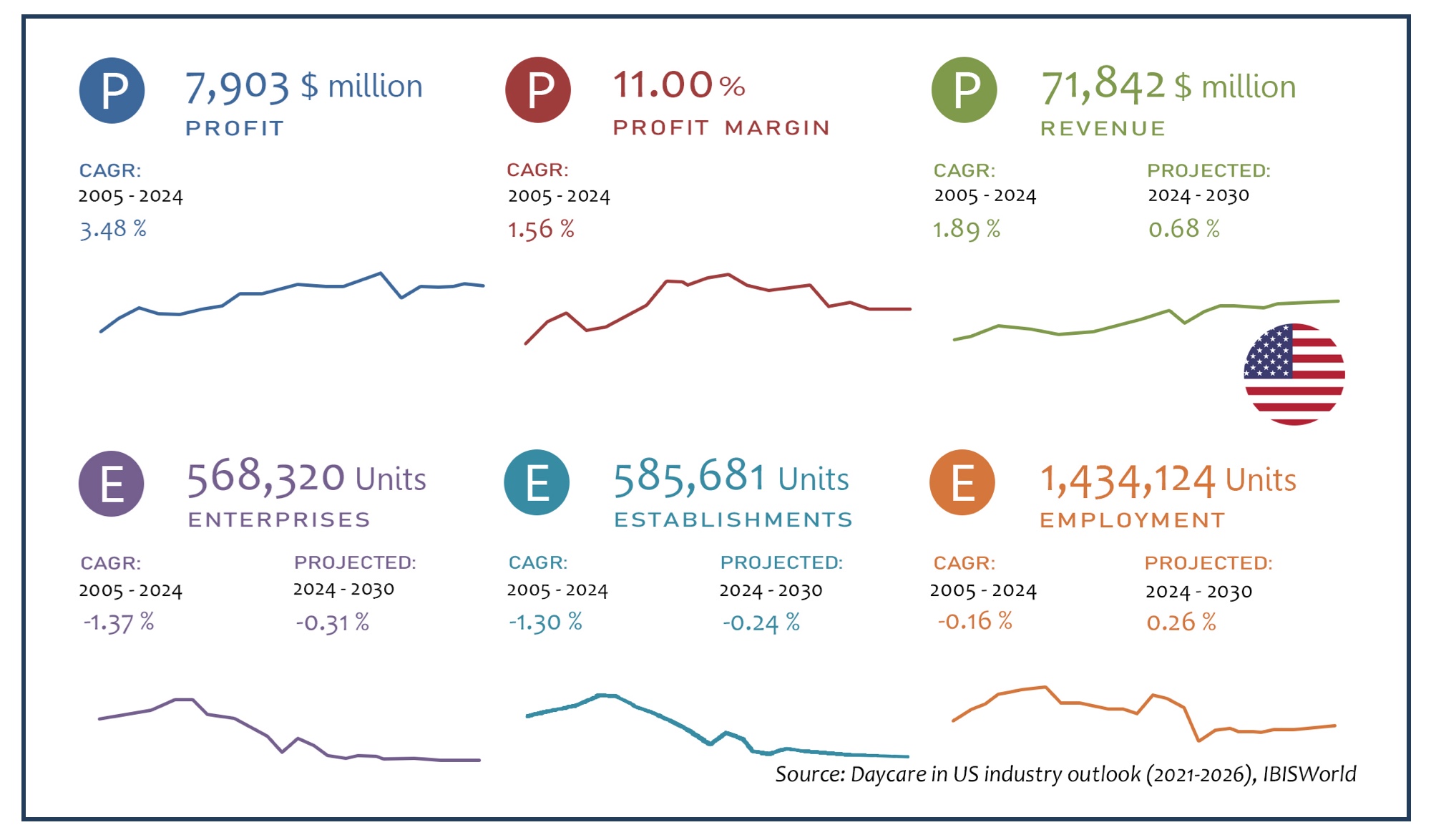

The U.S. Early Childhood Education industry generates $71.8 billion in revenue with an 11% profit margin. It employs 1.43 million people across 585,681 establishments. The sector is projected to grow at a CAGR of 0.68% from 2024 to 2030, indicating steady growth. Bright Lands Education views this industry as a promising acquisition target.

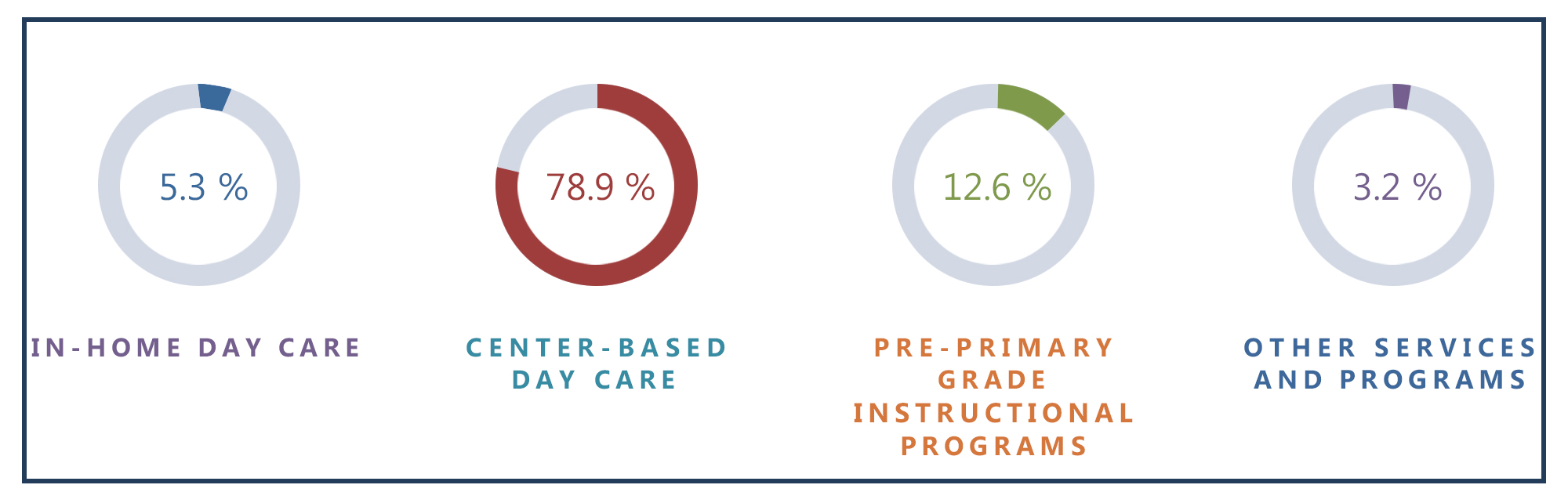

See infographic(above). As per IBIS World, in the US, center-based day care dominates child care arrangements, covering 78.9% of the market. These centers provide structured environments that support children's development and learning while accommodating more children per establishment, making them a reliable choice for working parents. Pre-primary grade instructional programs, which account for 12.6%, significantly enhance children's school readiness, giving them a competitive edge for future academic success. In-home day care, though smaller in market share at 5.3%, offers highly personalized and flexible care, often fostering a closer caregiver-child relationship.

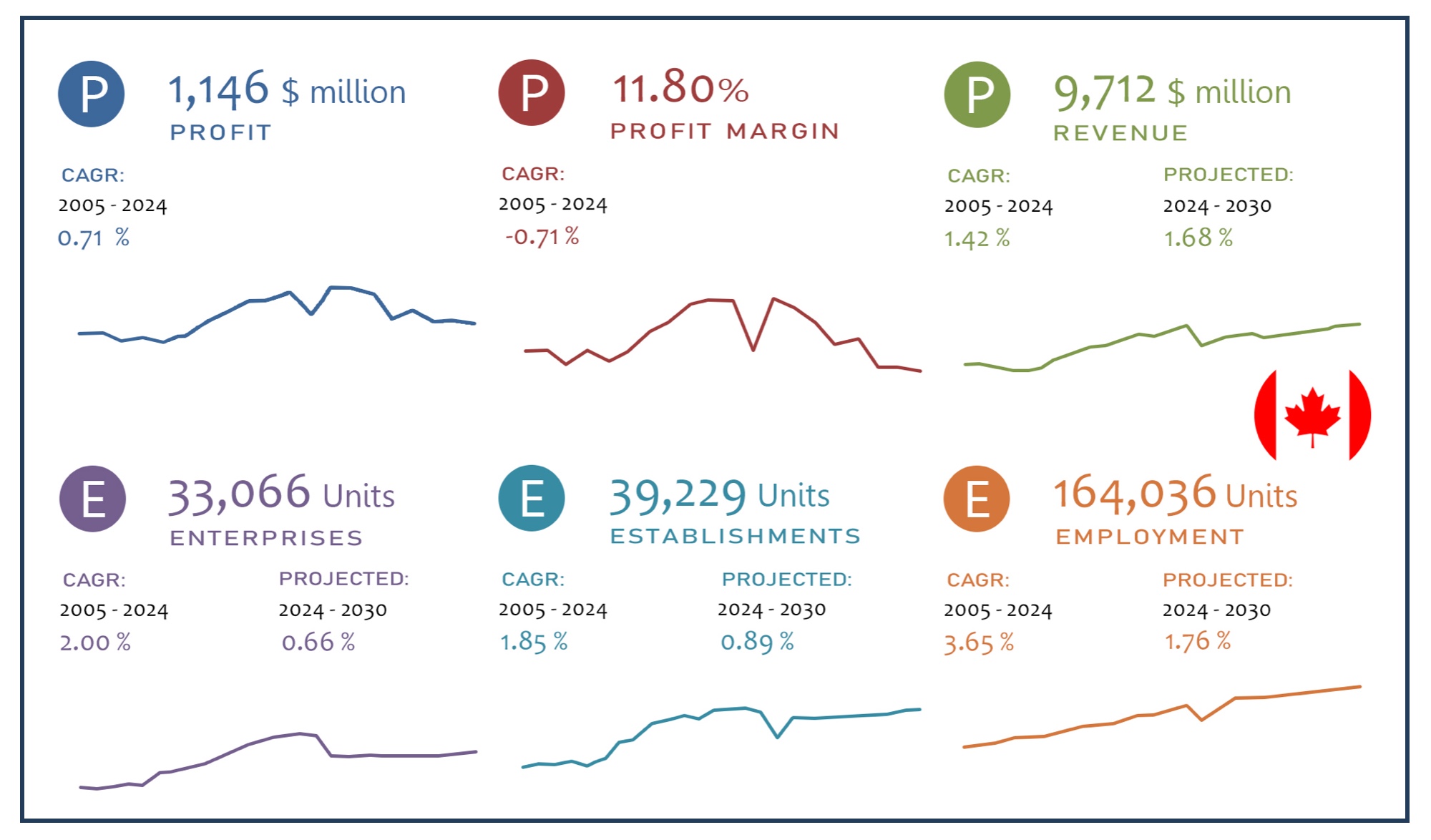

The Canadian daycare industry is a rapidly growing market that supports labor force participation, particularly for parents and mothers. It represents a critical service for two-income and single-earner families with children. As more women join the workforce, the demand for Early Childhood Education (ECE) services continues to rise and is forecasted to reach pre-pandemic levels. According to an IBIS World report in 2023, the industry is projected to generate $9.1 billion in revenue by 2026, driven by rising disposable income, decreasing unemployment, and an increasing number of children and immigrants.

Source: Day Care in Canada industry outlook (2021-2026). IBISWorld

Source: Day Care in Canada industry outlook (2021-2026). IBISWorld

Currently, the Early Childhood education industry in Canada generates $7.8 billion in revenue and is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.73% from 2021 to 2027. Wages paid to caregivers account for 64% of the industry's revenue, with profit margins averaging between 15-25%. Bright Lands Education recognizes the potential opportunities created by government subsidies, including the recently announced Canada-Wide Early Learning and Child Care (CWELCC) program, which has made quality care and education more affordable for families. The company has identified the ECE industry in Canada as a prime target for acquisition, starting its operations in British Columbia, with plans to expand to the eastern provinces in the future.

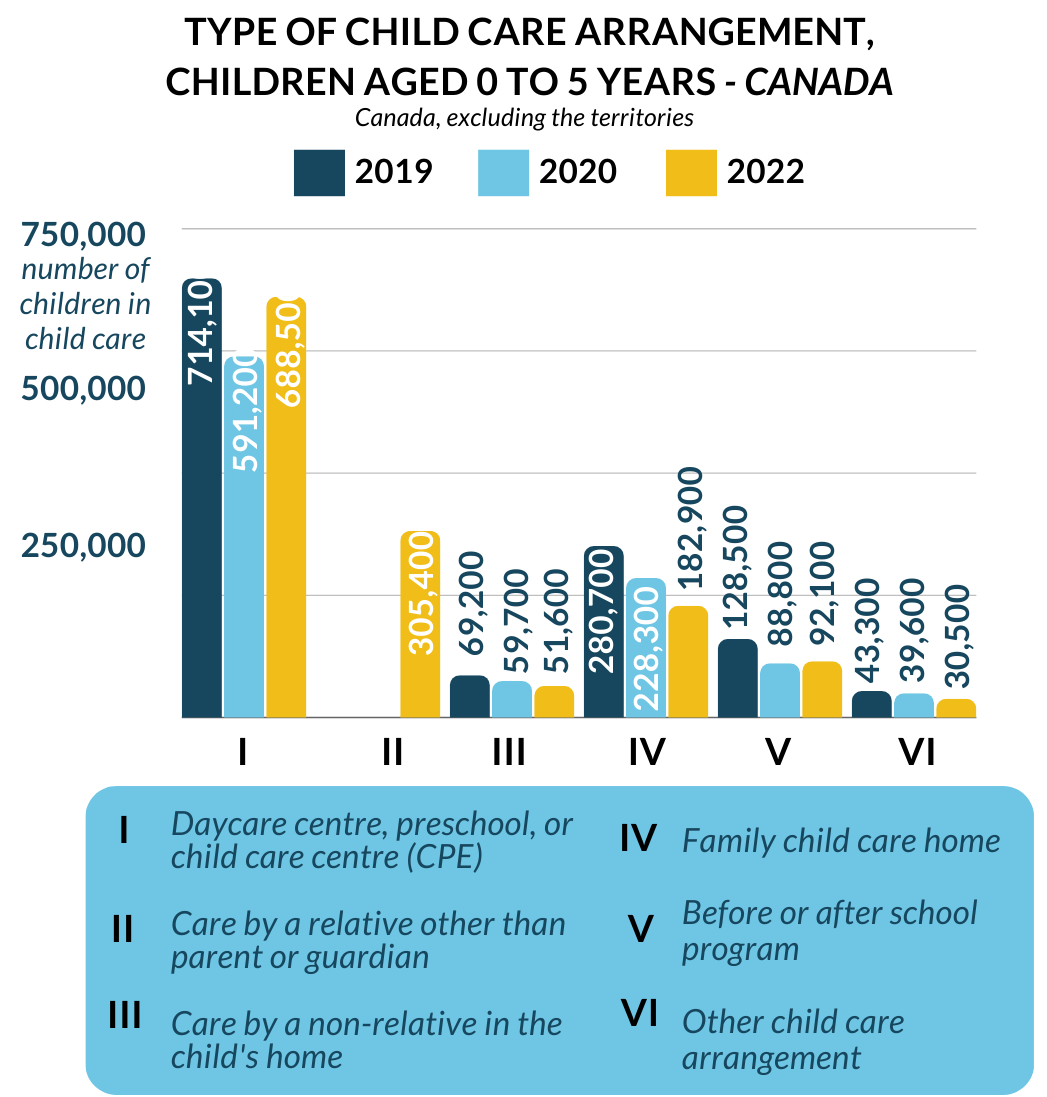

Bright Lands Education's entry into the Canadian market coincides with significant shifts in the industry due to the COVID-19 pandemic. The Survey on Early Learning and Child Care Arrangements (SELCCA) 2022 revealed that 52% of Canadian children under 6 years were in licensed or unlicensed child care, a rate unchanged from late 2020. While daycare centers, preschools, and centers de la petite enfance have returned to pre-pandemic usage rates, family childcare homes have seen a decrease in usage.

Source: Statistics Canada. Table 42-100-0004-01 Use of early learning and child care

arrangements, children aged 0 to 5 years; Child Care in Canada: Types, Cost & Tips

for

Bright Lands Educationmers | Arrive (arrivein.com)

Source: Statistics Canada. Table 42-100-0004-01 Use of early learning and child care

arrangements, children aged 0 to 5 years; Child Care in Canada: Types, Cost & Tips

for

Bright Lands Educationmers | Arrive (arrivein.com)

See infographic. This illustrates the proportion of children under 6 in childcare by type of arrangement for 2019, 2020, and 2022. Approximately 4 in 10 parents using child care in early 2022 reported difficulties finding it, with affordability and pandemic-related issues being significant factors. These challenges have impacted parents' work schedules and return-to-work plans. Bright Lands Education’s strategic acquisitions come at a promising time as the sector continues to adapt and recover from the challenges posed by the pandemic, with demand for high-quality and affordable services expected to grow.

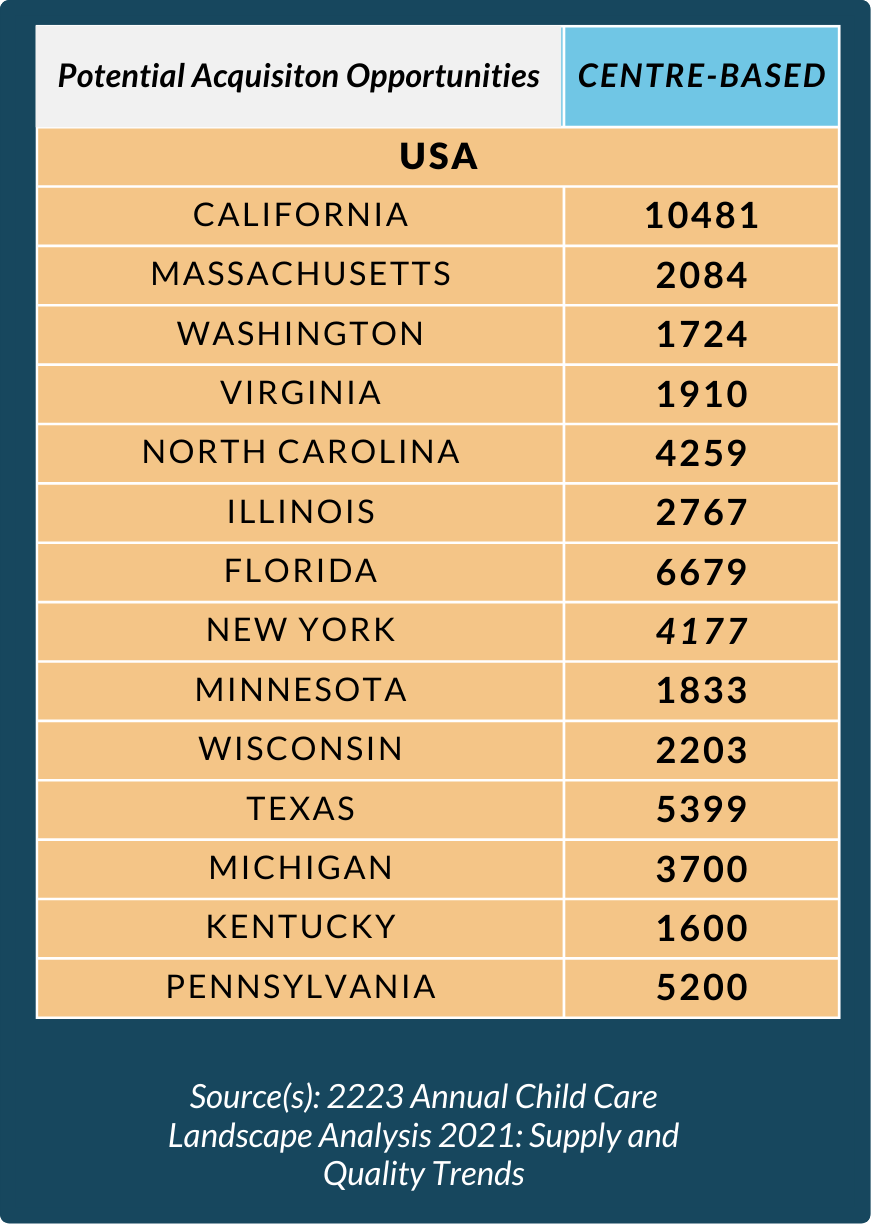

Bright Lands Education's strategy for expanding its business in the US focuses on a detailed geographic assessment of regulatory and market conditions across the country. Despite the company's interest in growing its presence in all states, it has opted focus on the following 14 states during its initial acquisition journey.

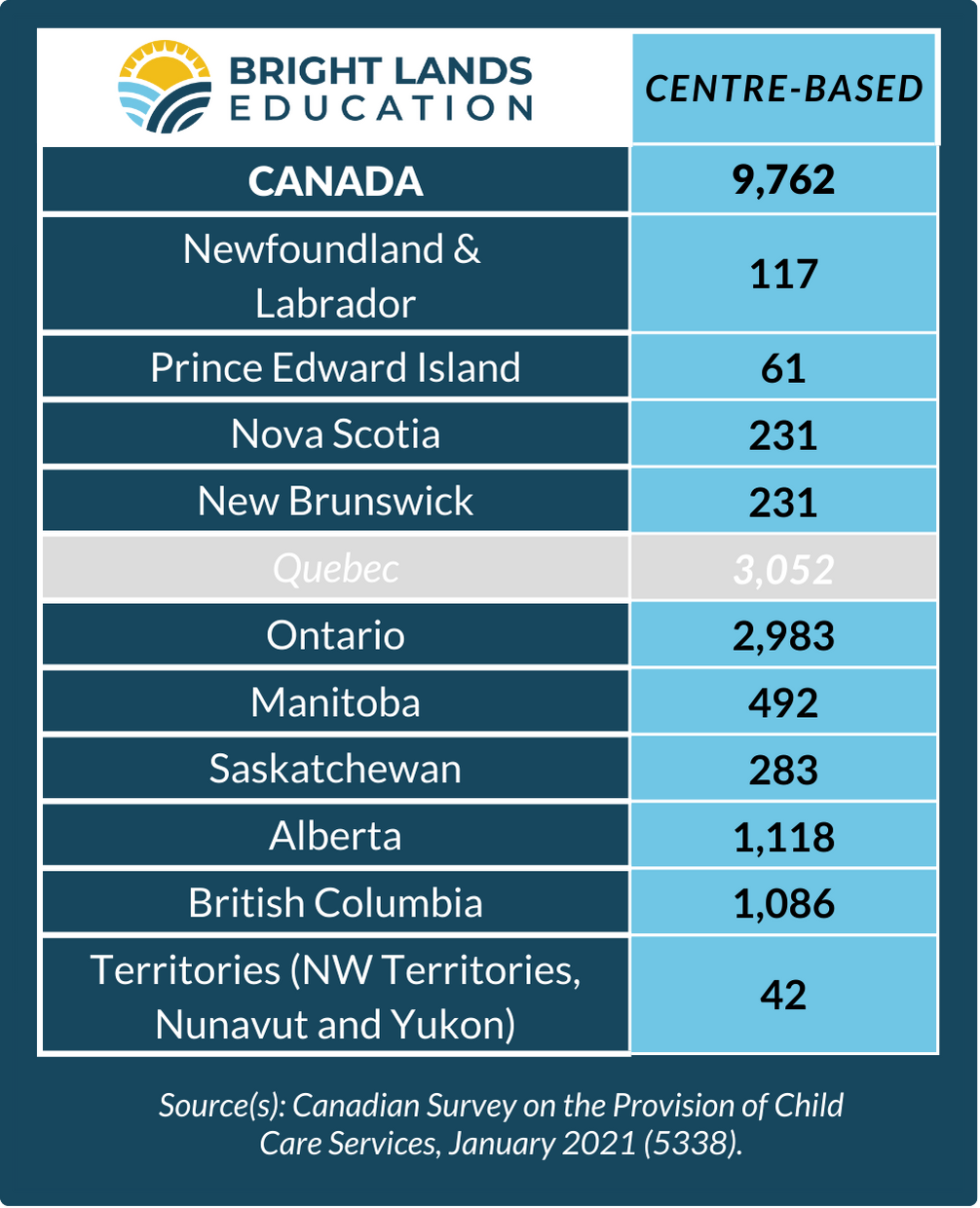

Bright Lands Education's acquisition strategy for expanding its business in Canada is marked by a geographic overview that considers various regulatory and market factors across the country. While Bright Lands Education is interested in expanding its operations to all provinces in Canada, it has decided to exclude Quebec due to the extra layers of regulation and a separate approach from the general federal regulations.

Let’s Discuss!